South Korea’s central bank is expected to freeze its policy rate at 3.25% during its last monetary policy meeting for this year to prevent any further fall in the country’s currency value against the US dollar despite a gloomy outlook for the country’s economic growth next year, according to a survey conducted by the Korea Economic Daily on Monday.

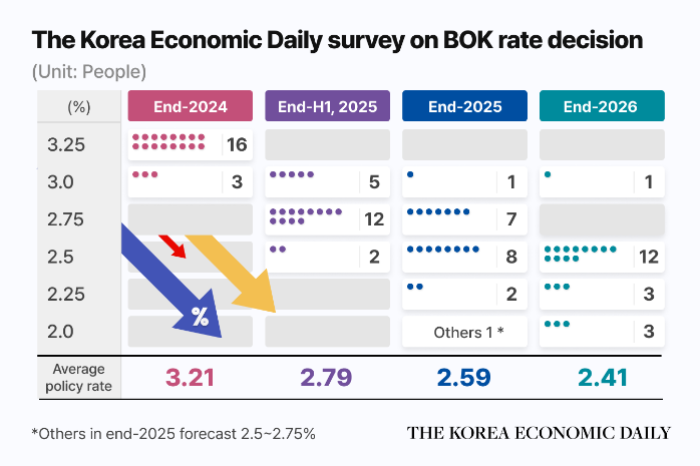

Of 19 economists responding to the major Korean economic and financial newspaper’s survey on the Bank of Korea’s decision on interest rates on Thursday, 16 economists projected the BOK will hold its policy rate unchanged at 3.25% after a quarter percentage point cut in the previous meeting.

They cited the country’s volatile dollar/won exchange rate as the main reason for a rate freeze at the central bank’s last monetary policy meeting for 2024.

“3.25% is not a restrictive level (to the economic growth),” said Lee Seung-heon, a professor at the business management department of Sungsil University and former BOK deputy governor.

“Big rate cuts could further strengthen the US dollar against the Korean won above 1,400 and set off a jump in real estate prices, which could result in economic instability.”

Lee Seung-hoon, an economist at Meritz Securities Co., also bet on a rate hold, saying that concerns about the highly volatile dollar/won rate outweigh concerns over domestic demand for now.

In October, the BOK lowered its benchmark interest rate by 25 basis points to 3.25%, marking its first rate cut since May 2020 and ending its monetary tightening cycle, which started in August 2021.

Other economists suggested the BOK make a rate move after confirming the US Federal Reserve’s stance on its monetary policy next month.

“The BOK is expected to make additional rate cuts after checking the Fed’s forward guidance in December,” said Min Ji-hee, a fixed-income analyst at Mirae Asset Securities Co.

According to the poll, the BOK’s policy rate is forecast to descend at gradual paces. Median rates suggested by the 19 economists stood at 3.25% at the end of 2024 and 2.75% in the first half of 2025.

It is expected to drop further to 2.50% at the end of 2025 and 2026.

VOLATILE USD/KRW RATE MOVES

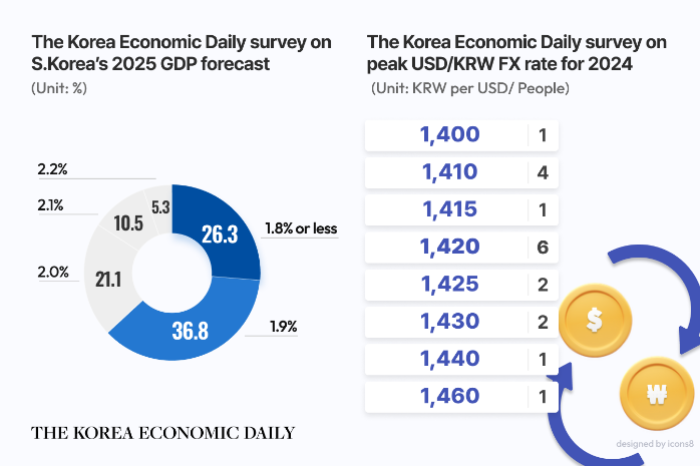

A majority of the survey respondents, 17 out of 18, forecast the US dollar will further strengthen versus the Korean won above 1,410 at the end of this year and even 12 respondents, or 66.7%, projected it will top 1,420.

But the dollar/won rate is expected to stabilize next year with the dollar’s gradual softening, according to the poll.

“The latest strong dollar has been largely driven by uncertainties over the Donald Trump administration’s policies,” said Park Choon-sung, a research fellow at the Korea Institute of Finance. “The dollar is expected to soften somewhat after the Trump government takes office in January.”

However, the dollar/won rate is forecast to stay above 1,350 even after its anticipated fall throughout next year, according to the survey.

Of the total survey respondents, seven economists, or 36.8%, forecast the dollar/won rate would hover between 1,350 and 1,400 at the end of the first half of next year and the end of next year. Less than 20%, or three, projected the rate would drop to the 1,200 won range at the end of next year.

Some even expected the dollar would regain ground against the won after the latter half of 2025 from the low 1,300 won level in the first half of next year to over 1,350 won in the second half on tax reduction-driven inflation concerns.

GLOOMY OUTLOOK FOR ASIA’S NO. 4 ECONOMY

Economists’ concerns over the Korean economy are high, according to the poll.

Of the total survey respondents, 12 economists, or 63.2%, forecast Asia’s fourth-largest economy will record a 2.2% growth this year, and three, or 15.8%, projected a 2.1% growth. Many of them have turned more bearish about the Korean economy since August when 95% projected a growth of 2.3% this year.

More than half of the respondents, 12 economists, forecast that the Korean economy will expand by less than 2% in 2025.

Park Seok-gil, executive director of JPMorgan Chase Bank Asia Economic Research, projected the Korean economy will grow less than 1.8% next year due to the country’s fizzling exports and weak domestic consumption.

“Korea’s potential economic growth rate has already retreated to the 1.8% range, meaning the country’s economy would grow 1.8% next year,” said NH Investment & Securities economist Ahn Ki-tae.

Last week, the International Monetary Fund (IMF) lowered its growth outlook for Korea to 2% for 2025 from a previous 2.2% growth forecast in October, citing high economic uncertainties and weak domestic demand.

The BOK projects a 2.1% growth while the Korean government and the Organization for Economic Co-operation and Development (OECD) maintained a forecast of a 2.2% gain.

By Jin-gyu Kang

josep@hankyung.com

Sookyung Seo edited this article.