North Asia-focused private equity firm MBK Partners is on the verge of clinching a major acquisition deal, offering a higher bid than other contenders for South Korea’s CJ Cheiljedang Corp.’s bio business – a deal estimated at 5 trillion won ($3.5 billion).

The deal, if finalized, will help MBK overcome the reputational risks surrounding it, arising from its troubled investment in Korea’s leading hypermarket operator Homeplus Co., analysts said.

According to investment banking sources on Thursday, MBK Partners recently submitted its bid for CJ CheilJedang’s green bio division.

While the exact terms could change depending on further negotiations, MBK’s bid is said to be in line with the sale price of about 5 trillion won expected by the seller, placing it ahead of competing bidders, sources said.

The final agreement will likely be reached by the end of this month after a series of detailed negotiations, they said.

Morgan Stanley is managing the sale of the bio business.

CHINA’S TWO LEADING BIOTECH FIRMS

Last month, MBK and two leading Chinese biotechnology firms – Guangxin Group and Meihua Group – joined the race for management control of CJ’s bio business in what would be Korea’s largest M&A deal this year.

China’s Guangxin and Meihua produce food additives such as MSG and nucleotides, as well as feed additives such as lysine and tryptophan, similar to CJ CheilJedang’s bio division.

The three bidders recently completed due diligence on the bio business.

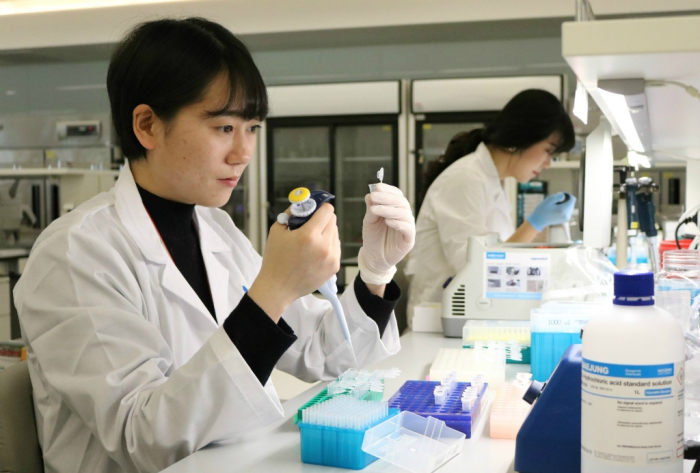

CJ’s bio business is an attractive asset, given its strong global presence and stable earnings.

The company’s production and sales network spans 11 countries, including the US, China, Indonesia and Brazil. It also boasts a large market share in China, the world’s biggest consumer of feed amino acids.

CJ is the world’s No. 1 player in amino acids, which account for 90% of its bio business sales. Feed amino acids were the driving force of the company’s ascent in the global food and beverage market.

In 2024, the company’s bio business posted 337.6 billion won in operating profit on sales of 4.21 trillion won, up 20% and 31% from the previous year.

CJ Cheiljedang, the flagship unit of Korea’s food-to-entertainment conglomerate CJ Group, is selling the bio business in line with the parent group’s restructuring efforts to revive sagging sales at its two growth pillars: food and entertainment.

CJ CheilJedang put its bio business on the market last December, initially attracting interest from buyout firms, including Blackstone, The Carlyle Group and MBK Partners.

LARGEST CRISIS IN ITS HISTORY

MBK Partners recently made headlines when Homeplus, a leading Korean hypermarket operator, filed for corporate rehabilitation with a Seoul court amid increasing market concerns about its squeezed financial position.

In 2015, MBK acquired 100% of Homeplus for 7.2 trillion won from British retailer Tesco Plc in what was at the time its biggest acquisition and the largest leveraged buyout (LBO) transaction in Asia.

With Homeplus set to come under court protection, however, MBK faces mounting scrutiny over its aggressive LBO-driven investment strategy.

MBK is also in a protracted dispute with Korea Zinc Inc. over the management control of the world’s top lead and zinc smelter.

Analysts said MBK appears to be betting on the high-profile CJ bio business acquisition as a way to regain market confidence.

If the CJ deal is confirmed, it will bolster MBK’s standing in the M&A market, they said.

By Jun-Ho Cha and Kyung-Mok Noh

chacha@hankyung.com

In-Soo Nam edited this article.