South Korea’s much-anticipated inclusion of its bonds in the FTSE World Government Bond Index (WGBI) has been postponed to April 2026 from November 2025 – a move that could complicate the new government’s efforts to stimulate the domestic economy.

FTSE Russell, the global index provider, said on Tuesday that while Korea will still be fully incorporated into the benchmark by November 2026 as announced earlier, the start date of inclusion will be pushed back by five months.

The adjustment comes as investors, particularly from Japan, requested additional time to prepare for infrastructure improvements and procedural clarity.

The revised schedule means that instead of being added in quarterly increments of 25%, the inclusion of Korean government bonds will now be phased in over eight months in smaller monthly tranches from April 2025.

The delay marks the first time a WGBI inclusion timeline has been officially shifted after a country has already secured eligibility.

While China previously saw its WGBI incorporation stretched out over three years, that was part of an earlier transition plan due to systemic investment hurdles.

TECHNICAL DELAY VS INVESTOR CONCERNS

Some market observers attributed the delay to lingering foreign investor concerns over Korea’s political and economic stability, pointing to structural vulnerabilities exposed by trade frictions with the US under the Trump administration and lingering political uncertainty following a presidential impeachment.

The inclusion postponement comes just a few days after Korea’s Constitutional Court removed President Yoon Suk Yeol from office over his short-lived martial law imposition in December.

Prime Minister Han Duck-soo doubles as the country’s acting president until a national leader is chosen at a presidential election on June 3.

Earlier this week, J.P. Morgan revised down its 2025 growth forecast for South Korea from 0.9% to 0.7% after lowering it from 1.2% just a week prior.

The continued downward revisions reflect a deteriorating macroeconomic outlook, further complicating the new government’s fiscal maneuvering room, analysts said.

‘JAPAN REQUESTED MORE TIME FOR TESTING’

Korea’s finance ministry, however, rejected political concerns as the reason for the postponement.

Instead, it pointed to technical requests from Japanese institutional investors, who are expected to contribute up to 30% of the fund inflows tied to WGBI inclusion, as the main factor.

The Seoul government noted that Japan’s complex multi-step bond ordering process required extended testing, which FTSE Russell took into account when rescheduling.

“FTSE Russell adjusted the start date in line with investor feedback,” Kim Jae-hwan, director general of International Finance Bureau at the Ministry of Economy and Finance, said in a media briefing. “Japanese institutions emphasized the time-consuming nature of their bond purchasing systems.”

FINANCIAL IMPLICATIONS

Last October, FTSE Russell, the global index subsidiary of London Stock Exchange Group plc, said Korea will be included in its global bond index starting in November 2025.

FTSE Russell placed Korea on its watchlist for inclusion in September 2022.

The National Pension Service, Korea’s state-run pension fund and the country’s largest institutional investor, previously estimated that WGBI membership could draw at least $56 billion into the country’s financial markets.

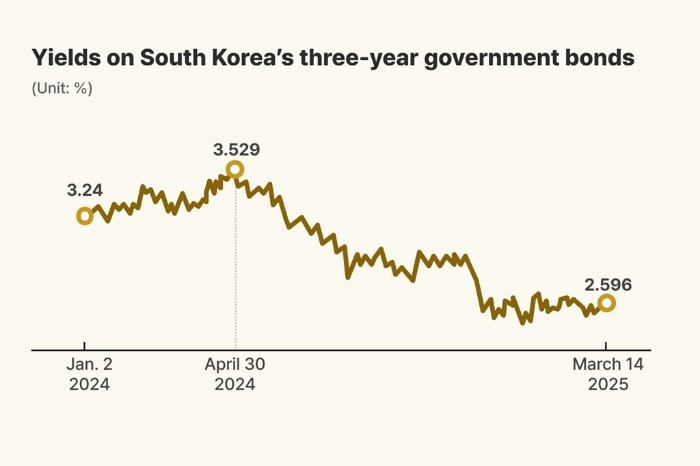

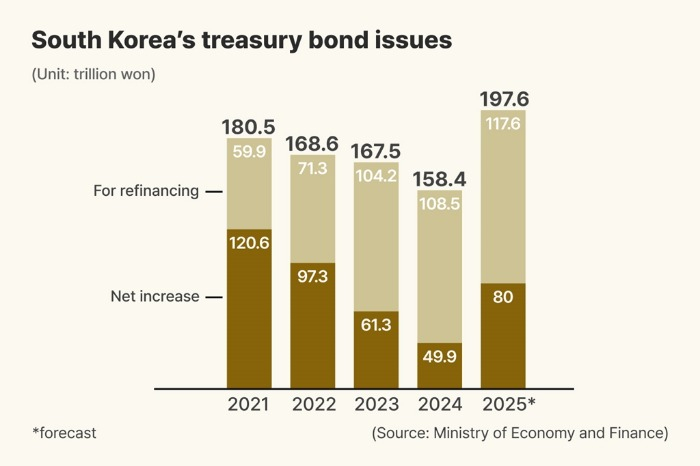

Those capital inflows, expected to ease government borrowing costs and help stabilize the won, will now arrive later than hoped, as the government looks to ramp up bond issuance to finance a supplementary budget.

With record-high sovereign debt issuance already on Korea’s financial books and a widening fiscal gap due to two consecutive years of revenue shortfalls, the deferral threatens to stretch the government’s borrowing capacity even further, analysts said.

VOLATILE CURRENCY MARKET

Industry watchers said investor sentiment is fragile amid global risk-off conditions, geopolitical tensions and lingering trade disputes.

Park Sang-hyung, chief economist at iM Securities, said the timing of the postponement couldn’t be worse.

“The incoming administration will certainly hope to front-load stimulus, possibly through an aggressive supplementary budget. But the expected demand from institutional investors in November and December is now off the table. That puts significant strain on the market’s ability to absorb additional bond supply. Long-term yields may rise as a result,” he said.

Meanwhile, the Korean currency, which recently hit its lowest level against the dollar since the global financial crisis, could face renewed downward pressure.

“If the expected foreign capital inflows don’t materialize this year, that could exacerbate currency volatility,” he said.

By Yeong-Hyo Jeong

hugh@hankyung.com

In-Soo Nam edited this article.