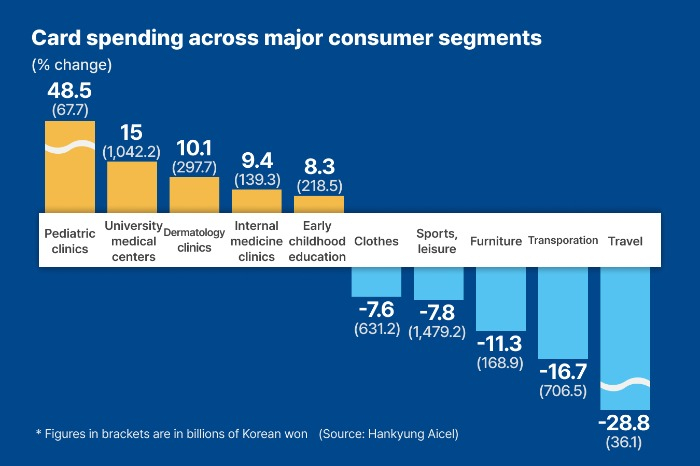

South Korean consumers exhibited recessionary spending behavior in March, cutting expenditures across nearly all sectors, except healthcare and education.

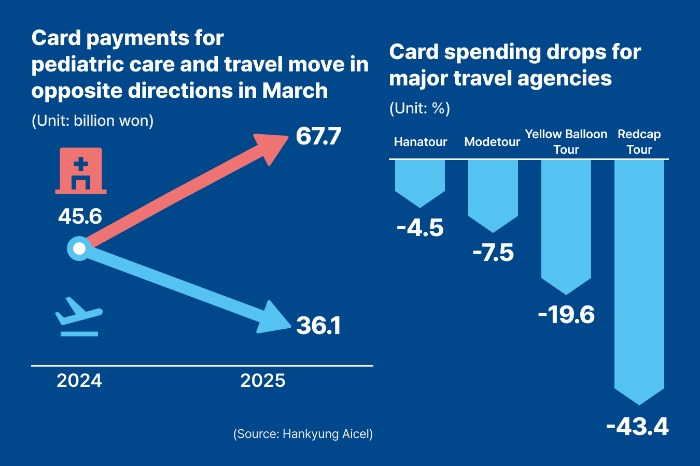

Travel, leisure and household goods were among the hardest hit. Card spending on travels plummeted 28.8% on-year in March, marking the sharpest decline among the major 59 consumer segments tracked by the alternative data platform Hankyung Aicel.

In contrast, Koreans didn’t cut back on education. Card spending on private education institutes rose 4.3% to 1.39 trillion won ($974 million) in March from the year prior, despite their annual tuition hikes early this year.

Card payments for general hospitals leapt 15.0% on-year to 1.04 trillion won last month. In terms of percentage growth, early childhood education and pediatric care led the gains in medical and education spending.

“This is characteristic of recessionary consumption, with consumers curbing non-essential spending due to concerns over future income,” said Lee Eun-hee, professor emeritus of consumer science at Inha University. “Both the government and the private sector need to mobilize efforts to stimulate domestic demand.”

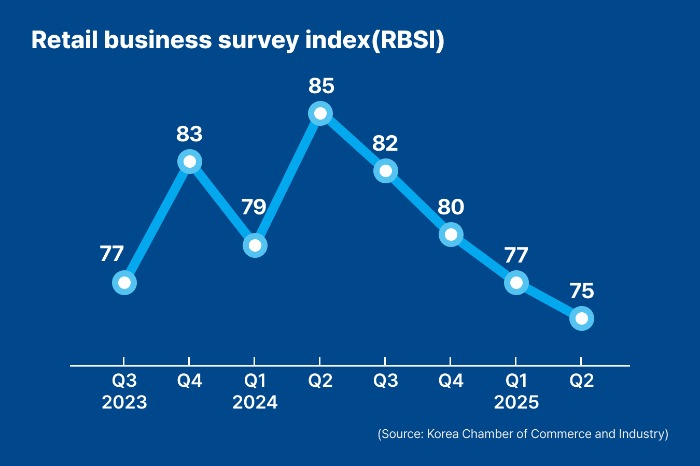

Retail industry observers expect defensive spending to continue into the second quarter as both companies and consumers brace for the impact of trade tensions with Washington following the Trump administration’s tariff hikes.

TRAVEL

Card payments for travel agencies, including RedcapTour Co., Yellow Balloon Tour Co. and Modetour Network Inc., plunged a combined 28.8% in March from a year earlier. Spending on leisure and cultural activities fell 7.8%, while household furniture purchases dropped 11.3%.

The Hankyung Aicel, under The Korea Economic Daily, estimates weekly payment volumes based on transaction data from more than 20 million card users.

Waning demand for travel and dining out led to lower mobility. Transportation spending decreased 16.7% to 706.5 billion won, marking the second consecutive monthly decline.

Card payments for major airlines such as Korean Air Lines Co., Asiana Airlines Inc., Jin Air Co. and Jeju Air Co. declined by 9.1%, 24.8%, 33.0% and 5.0%, respectively, in March.

CINEMAS, CLOTHES

South Korea’s two leading multiplex operators CGV and Megabox saw card transactions fall by 37.1% and 35.0%, respectively, in March, compared to a year-earlier period.

Among clothing brands, sportswear giant Nike suffered the sharpest drop, with card transactions on its online store down 21.3% on-year.

Bucking the trend, 27 out of the 59 major consumer segments posted on-year increases in card payments last month. More than three-quarters of them were concentrated in medical and educational categories.

Card spending at pediatric clinics soared 48.5% to 67.7 billion won from a year earlier, while card payments for early childhood education rose 8.3% to 218.5 billion won over the same period.

There are few signs of a recovery in consumer spending for the time being.

The retail business survey index, compiled by the Korea Chamber of Commerce and Industry, has extended its downward trend since hitting 85 in the second quarter of 2024. For the current quarter, the index slid to 75 versus 77 three months before.

By Yoon-Sang Koh

kys@hankyung.com

Yeonhee Kim edited this article.