South Korea’s top four financial holding firms are estimated to have posted their highest-ever profits in 2024, driven by hefty interest income after they raised lending rates despite the Bank of Korea’s interest rate cuts.

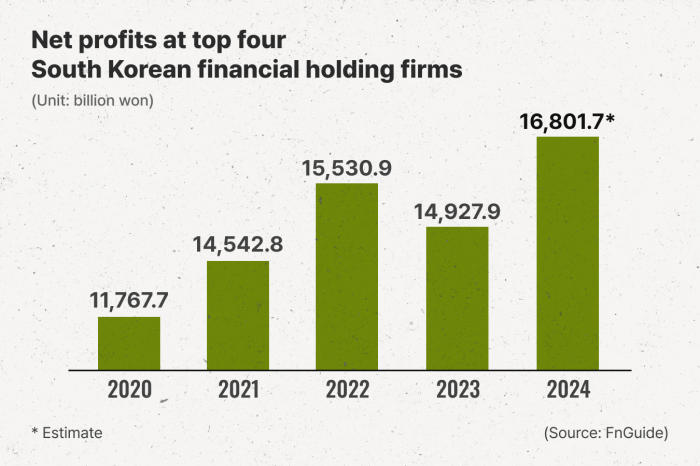

Net profits at the four holding companies – KB Financial Group, Shinhan Financial Group, Hana Financial Group and Woori Financial Group – reached a combined 16.80 trillion won ($11.5 billion) on a preliminary basis last year, according to market tracker FnGuide on Monday.

The figure marks a 12.6% increase from the year prior and broke the record of 15.53 trillion won set in 2022 when the country’s interest rates were on an upward trajectory. They are slated to release 2024 results this week.

KB Financial is likely to become the first South Korean financial holding company to hit the 5-trillion-won milestone. Its 2024 earnings are estimated at 5.06 trillion won, compared to 4.56 trillion won the year before.

Accounting adjustment at two insurance arms — KB Insurance Co. and KB Life Insurance Co. – were credited in part to the income growth.

They booked assets and liabilities at current market prices following the introduction of the IFR 17 in 2023, leading to improved earnings.

Korean lenders raised interest rates on new loans sharply in the fourth quarter when the Bank of Korea slashed policy interest rates by half a percentage point to 3.00% in its first back-to-back rate cuts since the 2009 global financial crisis.

With the government striving to curb household debt growth, new borrowers faced higher borrowing costs, leading to higher interest margins for domestic banks.

According to the Korea Federation of Banks, the banking arms of the four major financial holding firms – Kookmin Bank, Shinhan Bank, Hana Bank and Woori Bank – saw a widening of their interest income spread to 1.46% in December, compared to 0.94% in August last year.

Woori Bank recorded the highest spread at 2.09% among the top five domestic banks, including NongHyup, in December. The figures are based on the lending rates for new loans.

SURGE IN FOURTH-QUARTER INCOME

In the fourth quarter, KB Financial saw its net income soaring 182.3% to 721.0 billion won from the same period of last year, according to FnGuide.

Net income at Shinhan Financial and Hana Financial in the same period is estimated to have spiked 28.9% on-year to 708.5 billion won and 34% to 594.5 billion won, respectively.

Woori Financial saw a whopping 475.6% surge to 392.0 billion won in fourth-quarter net profit.

BASE EFFECT

A banking industry official attributed the stellar 2024 results in part to the base affect after domestic lenders set aside a substantial amount of provisions to cover potential losses related to soured project financing at the end of 2023.

In late 2023, financial troubles at Taeyoung Engineering & Construction Co. shocked the local financial industry amid fears of a possible domino effect.

Industry observers warned that record-breaking earnings at domestic financial services groups could lead to regulators pushing them to lower lending rates.

By Mi-Hyun Jo

mwise@hankyung.com

Yeonhee Kim edited this article.