South Korea’s major e-commerce platforms, including Naver Shopping, are showing signs of slowing growth amid the rise of Chinese platform giants and fierce competition with domestic online retailers handling specialized items.

Industry data showed on Monday that leading Korean online platform operators are at a crossroads as their sales and transactions are on a downward trajectory.

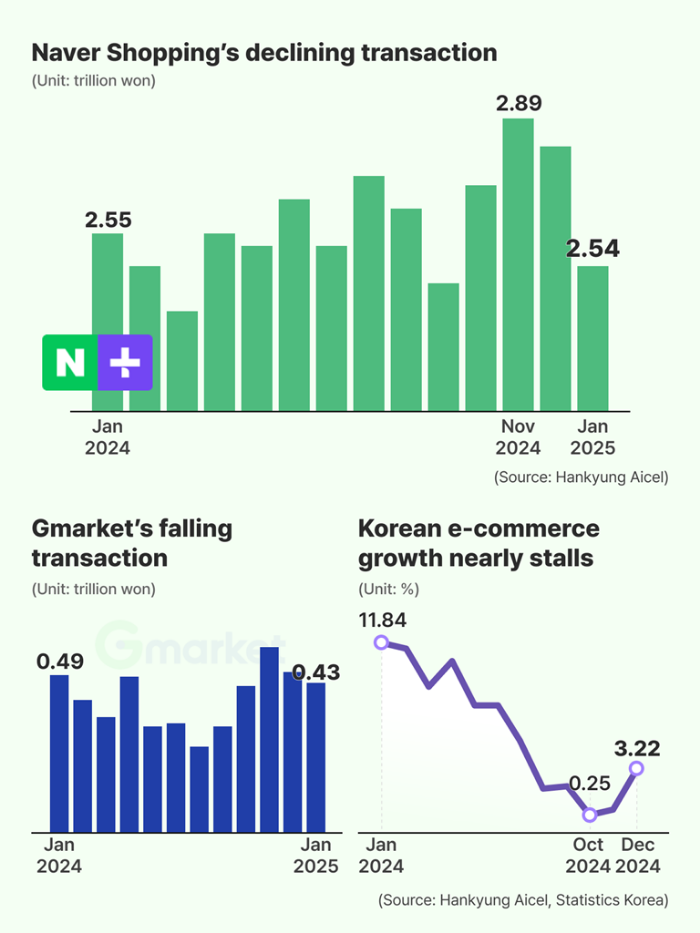

According to Korean alternative data platform KED Aicel, credit card settlements through Naver Financial Corp., which reflect Naver Shopping’s transaction volumes, reached 2.54 trillion won ($1.76 billion) in January, down 0.35% from a year earlier.

That’s Naver Shopping’s first decline since tech giant Naver Corp. spun off its electronic payment business as a separate company in 2019.

Naver Financial’s credit card settlement data is a key indicator of Naver Shopping’s commerce revenue.

KED Aicel estimates Korean e-commerce transaction volumes weekly, using data from over 20 million members. The correlation between transaction volume and e-commerce revenue stands at around 95%.

KED Aicel is the alternative data service brand of Hankyung Aicel, renamed from Aicel Technologies Inc. after The Korea Economic Daily acquired the data firm from US-based policy and global intelligence provider FiscalNote Holdings Inc. for $8.50 million last October.

INDUSTRY-WIDE STAGNATION

Naver Shopping is not the only platform facing difficulties.

Gmarket Inc., a unit of Shinsegae Group, and SK Square Co.’s e-commerce unit 11Street Co., which rank third and fourth, respectively, in Korea’s online market sector, are also witnessing downward trajectories.

Last month, Gmarket’s online settlement value dropped 12.9% on-year to 434.6 billion, while 11Street saw an even steeper 23% decline to 270.8 billion won.

Sales at Gmarket and 11Street have been sliding since early 2023.

Coupang Inc., the industry leader, is also struggling with falling sales growth.

Coupang’s January transaction value rose 14% on-year to 3.5 trillion won. But that was significantly slowed from a 25.6% on-year rise a year earlier and a 64% gain in January 2021, when Korea was at the height of the COVID-19 pandemic.

“Korea’s e-commerce market is entering a maturation phase while facing intense competition from Chinese platforms, which puts the domestic online shopping industry in a challenging situation,” said Samjeong KPMG Economic Research Institute in a research note. “Korean players need new growth drivers, particularly in the rapidly expanding cross-border e-commerce sector.”

A MARKET HEADED FOR ZERO GROWTH

Statistics Korea data showed domestic e-commerce platform operators are approaching zero growth.

Their online transaction value stood at 20.21 trillion won and 21.14 trillion won, respectively, in October and November 2024 – rising only 0.3% and 0.7% each from the year-earlier periods.

Their transactions in December – the most recent data available – showed a 3.2% rise from a year earlier.

Traditional e-commerce platforms are losing ground to online retailers that focus on a few items rather than general merchandise, such as fashion platform Musinsa; Ohouse, which specializes in lifestyle items; and Danggeun Market Inc., Korea’s largest online secondhand market service provider.

Known as Karrot in overseas markets, Danggeun swung to 17.3 billion won in operating profit in 2023 – its first profit since its inception.

Korea’s top women’s clothes app operator Ably Corp. also turned to a 3.3 billion won operating profit in 2023.

Last year, Chinese online shopping giant Alibaba Group Holding Ltd. invested 100 billion won in Ably, securing a 5% stake to tap into the nation’s booming online fashion market.

The investment is Alibaba’s first equity investment in a Korean shopping app platform.

CHINESE GIANTS’ GROWING PRESENCE IN KOREA

Korean e-commerce players face intensifying competition in the high-growth cross-border direct purchasing market, with Chinese rivals’ increased presence in the country.

According to Statistics Korea, Korean consumers’ direct purchasing through cross-border online shopping malls reached 7.96 trillion won – more than doubling from 3.64 trillion won in 2019.

“The rapid expansion of Chinese e-commerce companies into Korea is driving a surge in direct overseas purchases, particularly from China,” Samjeong KPMG said in the report.

In recent years, Chinese e-commerce giants have increasingly attracted Korean consumers to their online platforms with cheaper products and sometimes faster deliveries than their Korean rivals.

Temu, a popular Chinese discount e-commerce platform that entered Korea in 2022, has cracked homegrown players’ dominance in the online retail space. AliExpress and fashion e-retailer Shein are also luring Korean consumers with ultra-low prices.

STRATEGIC ALLIANCES

Analysts said Korean e-commerce players are seeking strategic partnerships with foreign rivals to survive.

Last December, Korea’s retail conglomerate Shinsegae Group agreed to set up an e-commerce joint venture with Chinese online shopping giant Alibaba to better compete in Korea’s fast-paced online retail sector.

While Shinsegae’s Gmarket and Alibaba’s AliExpress will be incorporated into the JV, the two platforms will continue to be operated independently, according to Shinsegae.

Analysts said the partnership will allow Gmarket and another Shinsegae affiliate E-Mart Inc. to leverage Alibaba’s global sales network to expand overseas.

By Tae-Ho Lee

beje@hankyung.com

In-Soo Nam edited this article.