South Korea’s National Pension Service (NPS) has selected three asset managers to oversee its domestic core real estate platform fund – the state pension fund’s first such allocation since 2018.

According to investment banking industry sources on Sunday, The state-run pension fund, the country’s largest institutional investor, has appointed KB Asset Management, Samsung SRA Asset Management and Capstone Asset Management as the core platform fund managers.

The selection follows an initial screening last month, when six asset managers – Korea’s top real estate asset management firm IGIS Asset Management; Samsung SRA; KB Asset; Capstone Asset; Hyundai Investments; and ARA Korea Asset Management – were shortlisted.

SEED MONEY

The domestic core real estate platform fund garnered significant industry interest, with more than 20 asset management firms expressing intent to participate when the NPS initiated its request for proposals late last year.

The NPS, the world’s third-largest institutional investor, will grant each of the selected managers 250 billion won ($172 million). These firms will use the NPS’ capital as seed money to raise additional investments.

The three real estate core platform fund operators are required to invest at least 30% of their funds in assets such as data centers, urban logistics facilities and healthcare properties, while the remainder can be allocated to office and retail properties. For office investments, co-investments with strategic investors will be permitted.

RENEWED PUSH INTO ALTERNATIVE INVESTMENTS

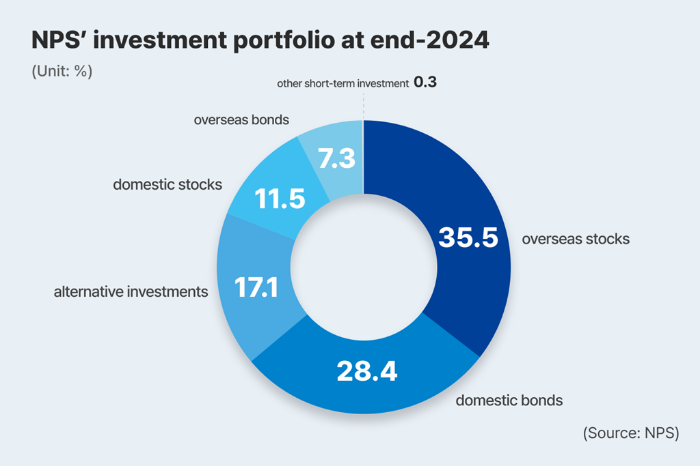

The selection of core platform fund managers underscores the NPS’ renewed push into alternative investments.

The move comes as the pension fund plans to implement a new “benchmark portfolio” framework this year, which removes asset class constraints under certain conditions.

Industry officials said the pension fund’s policy shift will catalyze further real estate investments as it strives to diversify its portfolio amid evolving market conditions.

Last week, Seo Won-joo, chief investment officer of the NPS fund management division, said the state fund will introduce a new benchmark portfolio framework to improve gains from its alternative investments.

The new benchmark portfolio will be initially applied to alternative investments that offer relatively lower risk and higher returns, before expanding to equities and bonds over time, according to the NPS.

RECORD-HIGH INVESTMENT IN DOMESTIC PROPERTY MARKET

Last December, sources said the NPS plans to invest 2 trillion won in the domestic real estate market in 2025 – its largest annual investment ever – to gain from an expected recovery in the commercial property sector amid low-interest borrowing costs.

In 2024, the state pension fund posted an all-time high 15% return from its investment activities, buoyed by a US stock rally and gains from alternative investments.

The strong performance, its highest since the launch of the NPS fund in 1988, surpassed its previous record high of 13.59% in 2023.

At last year’s return rate, the state fund earned 160 trillion won in investment gains, with its total assets under management rising to 1,213 trillion won, or $830.3 billion, at the end of 2024.

The NPS has been under growing pressure to improve returns and enhance investment efficiency as the country’s aging population accelerates the fund’s long-term payout obligations.

By Gyeong-Jin Min

min@hankyung.com

In-Soo Nam edited this article.