South Korea’s top automaker Hyundai Motor Co. defied mounting global trade headwinds and a fresh round of US import tariffs to deliver record first-quarter revenue and stronger-than-expected earnings, boosted by resilient demand for hybrid vehicles, favorable exchange rates and solid US sales.

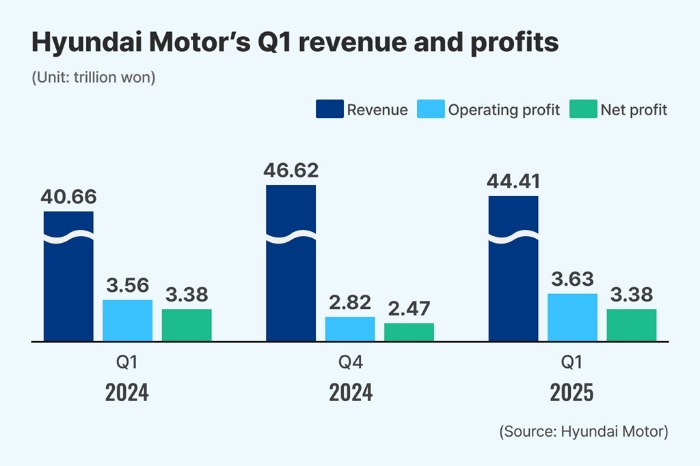

The flagship unit of Hyundai Motor Group posted an operating profit of 3.63 trillion won ($2.53 billion) in the first quarter, a 2.1% increase from a year earlier, according to a regulatory filing on Thursday.

Revenue rose 9.2% on-year to 44.41 trillion won, marking the highest first-quarter sales in the company’s history. Net profit came in at 3.38 trillion won, barely changed from the year-earlier period.

First-quarter operating profit margin stood at 8.2%, down from 8.7% a year earlier.

The results outpaced analyst consensus forecasts and were seen as a strong showing given the market chill triggered by the Trump administration’s announcement to impose 25% tariffs on vehicle imports to the US starting April 3.

The levy, part of Washington’s escalating trade stance, has roiled global automakers, with Hyundai standing out for its ability to weather the turbulence – at least for now.

RECORD QUARTERLY US SALES AHEAD OF TARIFF ENFORCEMENT

Despite a slight 0.6% decline in global vehicle sales to 1,001,120 units in the first quarter, Hyundai’s performance was underpinned by a 10.1% jump in US sales to an all-time high of 203,554 units for the quarter, as dealers rushed to stockpile inventory ahead of the tariff enforcement.

Across all global markets excluding Korea, Hyundai sold 834,760 units in the first three months of the year, down 1.4% from a year ago.

Eco-friendly vehicles were the cornerstone of Hyundai’s first-quarter performance, with hybrid and electric models together accounting for a growing share of global sales.

Eco-friendly vehicle deliveries climbed 38.4% on-year to 212,426 units globally, including 137,075 hybrids and 64,091 EVs.

These higher-margin, eco-friendly vehicles contributed significantly to the group’s decent profits in the quarter, company officials said.

The Korean won’s depreciation also provided a tailwind, with the average dollar-won exchange rate rising 9.4% on-year to 1,453 won per dollar in the first quarter.

Hyundai estimates that every 10% gain in the dollar lifts its operating profit by about 270 billion won.

CHALLENGES AHEAD

Hyundai executives signaled caution about the automaker’s outlook for the rest of the year.

With US auto tariffs now in full effect and extra levies on auto parts set to begin May 3, the company warned of challenges to its profitability and operations.

“We have established a task force to address US tariff challenges,” said Chief Financial Officer Lee Seung-jo during an earnings conference call with analysts.

Hyundai is also enhancing production efficiency at its plant in Alabama and the newly established EV plant in Georgia – Hyundai Motor Group Metaplant America (HMGMA) – to cut costs, he said.

Vehicles exported from Korea to the US accounted for about 57% of Hyundai and affiliate Kia Corp.’s combined US sales in 2024 – about 1.01 million units.

For now, Hyundai intends to rely on US inventory built before the tariff and maintain current pricing through June 2, according to company sources.

Industry watchers said Hyundai, just like its global peers, will likely suffer from falling sales volumes and worsening profitability in the second half as the tariff impact deepens.

To mitigate the risk, Hyundai plans to scale up local production in the US and accelerate the rollout of new models, including the All-New Palisade, All-New NEXO and the facelifted version of the IONIQ 6.

In a statement, Hyundai cited rising trade tensions and a potential global economic slowdown as key risks, adding that an unpredictable macro environment would require “structured and agile countermeasures” backed by deeper localization strategies in key markets.

Earlier this week, Hyundai Motor Group said it plans to unveil 42 new models, including hybrid, next year to cope with the US auto tariffs, the prolonged weakness in the EV sector and the global economic slowdown.

A 25% HIKE IN Q1 DIVIDEND

To reinforce investor confidence, Hyundai Motor announced a 25% hike in its first-quarter dividend to 2,500 won per common share, up from 2,000 won a year ago.

It also plans to cancel 1% of its outstanding shares and retire a portion of treasury stock as part of its shareholder return program.

“Despite weakening demand in emerging markets and increased macroeconomic uncertainty, Hyundai has achieved qualitative growth through a higher share of value-added vehicle sales, including hybrids,” said a company official. “We are committed to our shareholder return policy and to enhancing long-term competitiveness through bold innovation.”

Meanwhile, Hyundai Motor Group said on Thursday it has opened the Hyundai Center of Excellence for future mobility technology (Hyundai CoE) at the Indian Institute of Technology (IIT) Delhi.

The initiative is to establish a joint research system to advance future mobility technologies focused on electrification and battery systems, reflecting the automotive group’s commitment to driving innovation tailored to the needs of Indian customers, it said.

By In-Soo Nam

isnam@hankyung.com

Jennifer Nicholson-Breen edited this article.