South Korea’s chemical-to-defense conglomerate Hanwha Group Chairman Kim Seung-youn will hand over half of his holdings in the conglomerate’s de facto holding firm Hanwha Corp. to his three sons, effectively ushering in a third-generation leadership era at one of the country’s largest chaebols.

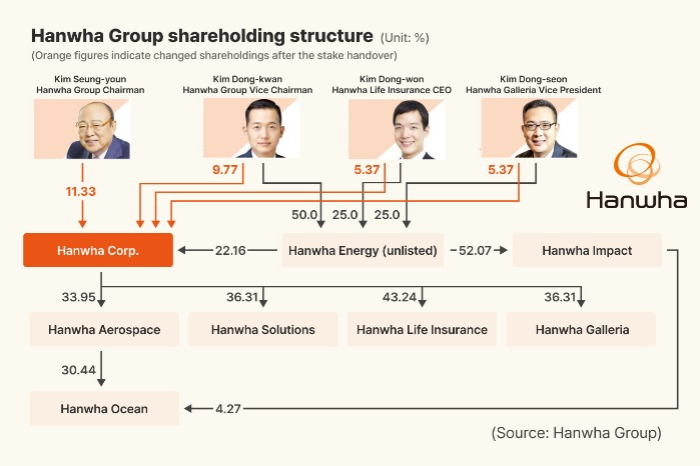

The group announced on Monday that Chairman Kim will transfer 11.32% of his 22.65% stake in Hanwha Corp. to his sons – Hanwha Group’s Vice Chairman Kim Dong-kwan (42), Hanwha Life Insurance Co. Chief Executive Kim Dong-won (40) and Hanwha Galleria Corp. Vice President Kim Dong-seon (36).

After the transfer, the three sons will collectively control 42.67% of Hanwha Corp. when combined with indirect holdings via Hanwha Energy Corp., a company they wholly own.

Of Chairman Kim’s 11.32% holdings, 4.86% will be handed over to the first son, and the remaining stake will be equally split between the younger two sons.

Following the stake handover, Chairman Kim’s holdings in Hanwha Corp. will drop to 11.32%, while the first son’s stake will rise to 9.77%, and the younger two sons’ holdings to 5.37%, respectively.

THREE SONS’ TIGHTER GRIP

The first son, Kim Dong-kwan, also the chief executive officer of Hanwha Solutions Corp., Hanwha Aerospace Co. and Hanwha Corp., holds a 50.0% stake in Hanwha Energy, and his two younger brothers share the remaining equally.

Considering that Hanwha Energy controls a 22.16% stake in Hanwha Corp., the first son will wield the largest 20.85% voting power in Hanwha Corp.

With Chairman Kim’s handover of his stakes in Hanwha Corp. to his sons, Korea’s seventh-largest family-controlled conglomerate’s leadership shift to its third generation has nearly been completed, said an unnamed official from the group.

The latest stake ownership change is expected to help Hanwha Group Vice Chairman and heir apparent Kim Dong-kwan further tighten his grip over the group’s defense, shipbuilding and energy businesses.

His two younger brothers, Kim Dong-won and Kim Dong-seon, are also expected to wield a greater deal of power over the group’s two other flagship businesses, financial and retail, respectively.

Chairman Kim will maintain his group chairmanship after the stake change to support seamless power transition to his three sons by advising management, according to the company official.

NO MERGER BETWEEN HANWHA AND HANWHA ENERGY

This succession move comes amid growing criticism surrounding a recent rights issue plan by Hanwha Aerospace, one of the group’s key subsidiaries and Korea’s leading defense company.

Hanwha Aerospace’s 3.6 trillion won ($2.7 billion) new share sale plan, announced late last month, has faced a backlash as it came about a week after the company spent 1.3 trillion won, or 94.5% of its cash and cash equivalent assets, to buy a 7.3% stake in Hanwha Ocean Co. from Hanwha Impact Co. and Hanwha Energy.

Hanwha Aerospace shareholders criticized the group for taking advantage of the defense company’s fat cash coffer to avoid hefty inheritance taxes during the leadership transition in the owner family.

Hanwha Group denied the accusation, saying that Hanwha Aerospace has acquired an additional stake in Hanwha Ocean to aid the shipbuilding unit’s business expansion in overseas markets.

Following the stake purchase, Hanwha Aerospace owns a 30.44% stake in Hanwha Ocean.

On Monday, Hanwha Aerospace announced an 11 trillion won investment plan, of which 3.6 trillion won will be funded via the rights offering and the remaining with cash and financial loans.

It will invest mainly in its deeper penetration into the defense market in Europe and the Middle East, the company said.

An official from Hanwha Group said Chairman Kim has decided to transfer his stakes in Hanwha Corp. to his sons as part of efforts to silence speculation about manipulating corporate valuations for the group’s leadership transition to his sons.

Following the Hanwha stake transfer announcement, the group’s unnamed official said the group has no plan to merge Hanwha Corp. and Hanwha Energy, which was expected to bump up shares of the family-owned group’s third generation in the de facto holding firm for less expensive power transition.

Earlier in March, Hanwha Energy embarked on its initial public offering process by inviting brokerage companies to lead its IPO.

Considering the electricity retail and solar energy company’s share ownership in Hanwha Corp., its IPO was seen as a prelude to a merger between the two companies.

By Woo-Sub Kim, Jin-Won Kim and Hyung-Kyu Kim

duter@hankyung.com

Sookyung Seo edited this article.