In an era of escalating geopolitical uncertainty, the head of one of the world’s largest private equity firms sees opportunity – not retreat.

Joseph Bae, co-CEO of KKR & Co. Inc., formerly known as Kohlberg Kravis Roberts & Co., believes the surge in global tensions has laid bare the fragility of supply chains overly reliant on specific regions.

Speaking in a recent interview with The Korea Economic Daily, Bae argued that the current environment – defined by heightened geopolitical risk – is, paradoxically, an optimal moment for investment, especially in strategic infrastructure such as AI, subsea cable networks and data centers.

“We are emerging from a period of benign globalization that made supply chains more interconnected and complex,” he said. “As volatility increases and competition intensifies, it is crucial to incorporate these factors into all investment decision-making, as few places will remain insulated from these impacts.”

His comments come as policymakers and corporations worldwide reassess the impact of hyper-globalization. The Trump administration’s imposition of high tariffs served as an inflection point, Bae noted, exposing the vulnerabilities inherent in overdependence on any single manufacturing hub.

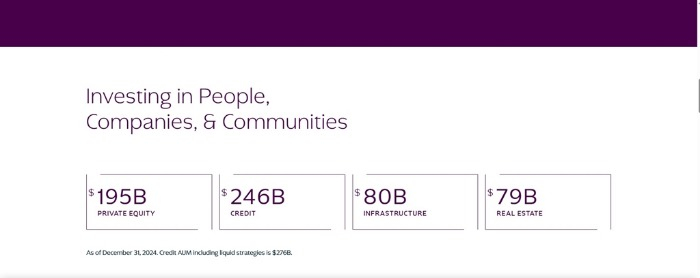

With $600 billion in assets under management at the end of 2024, the New York-based private equity firm has been expanding its real estate and infrastructure portfolio in South Korea, Asia’s fourth-largest economy.

Bae was named KKR’s co-CEO in 2021, along with Scott Nuttall.

Credited as “the architect of KKR’s expansion in Asia,” he spearheaded one of the firm’s most profitable exits from Korea’s Oriental Brewery Co., creating $4 billion in capital gains. KKR bought the beer brand for $1.9 billion from AB InBev in 2009 and sold it back to the Belgium-based brewer for $5.8 billion in 2014.

He also led high-profile carve-out deals for Japanese conglomerates, including Panasonic and Hitachi.

Born in 1973, Bae immigrated to the US at three with his father, a chemical research scientist, and his mother, a missionary.

After graduating magna cum laude from Harvard University with a bachelor’s degree, he landed his first job with Goldman Sachs’ proprietary investment division and joined KKR in 1996.

The following is an edited transcript of the interview with Joe Bae.

▶What is KKR’s view on Korea, and which sectors is KKR most excited about?

Korea is a key focus for KKR, not only in Asia but globally, due to the strength of Korean companies and their tremendous potential for growth domestically and internationally. We first entered Korea in 2009 and have since deployed more than $4 billion across some 20 companies, spanning multiple asset classes and strategies, including private equity, infrastructure, credit, real estate and technology growth.

We focus on a few key areas, including helping business groups achieve balance sheet and corporate governance objectives through corporate carve-outs, serving as value-added partners to Korean businesses and owners aiming to enhance operations and expand internationally, and supporting homegrown champions in their next phase of growth in the industrial, consumer, healthcare and services sectors.

▶The exchange rate (weak won versus strong US dollar) has made it more attractive for global investors or dollar-based funds to invest in Korea. Is this an opportunity to acquire good assets at a discount or is this an indication that the Korean economy has weakened?

Our conviction in Korea is not based on short-term exchange rate fluctuations but by the country’s strong long-term fundamentals.

While Korea faces certain macroeconomic challenges, these are common to other developed markets in North Asia and can present opportunities for Korean businesses to bring in the right partners to help them navigate the environment.

▶Korea has a high inheritance tax and the succession of second and third generations continues to play out. This presents investment opportunities. Is KKR interested?

Succession planning is one of many reasons business owners seek partnerships with private equity firms. We closely monitor the evolution of inheritance tax and have the expertise to assist with generational transitions and succession. However, our investment approach in Korea is fundamentally grounded in our being a value-added partner.

▶What is KKR’s macroeconomic outlook for Korea, and which industries are particularly attractive for private equity firms?

We expect Asia to become more “Asia-centric,” with trade increasing within the region rather than with developed markets in the West. As more Asian countries play an active role in driving the region’s global growth, significant opportunities will emerge in transportation assets, subsea cables, security, data and data centers, and energy transmission. AI, and the energy infrastructure needed to support its growth, will require substantial investment and we expect more global expansion from the region.

Demographic challenges to retirement security will become increasingly prominent as working-age populations start to peak in many parts of the world. Additionally, more governments will recognize the importance of retaining local capital flows in their own markets, as such, we are bullish on domestic retirement savings.

▶Shareholder activism and hostile M&As have increased in Korea. What is KKR’s investment philosophy when it comes to interacting with companies?

KKR’s investment philosophy is rooted in partnership. We seek good companies that we can help make great companies through our operational expertise and transformative value creation. The rise of shareholder activism underscores the need for companies to improve their return on equity, which creates opportunities for us to support Korean chaebol and conglomerates on carving out non-core assets to improve their balance sheet and meet corporate governance objectives.

▶Has there been any change in your investment philosophy since President Trump took office again?

Our investment approach remains fundamentally long-term, spanning beyond the term of any single administration. Looking back to the first Trump Administration, we can see that their focus on tariffs and trade was already evident.

Today, the issue around supply chain security and resiliency is top of the mind for all long-term investors. There is naturally uncertainty and volatility as the final policies have not been set and it is not clear how other countries and governments may react to the range of different outcomes.

▶KKR’s stock price has grown significantly over the past few years. Any secrets to attracting investors?

We believe investor confidence in KKR stems from a combination of three key reasons:

Powerful growth model: We have developed a robust model with three growth engines: our Asset Management business, which has delivered strong returns for our investors over five decades; our Insurance business, which is delivering for policyholders and on a strong growth trajectory; and Strategic Holdings, which applies a very long-term investment mindset.

Together, these engines enable us to provide retirement and financial security for millions of individuals while delivering value to our shareholders. Meeting critical needs: There is a significant need for what we do. Businesses need capital partners to help them grow. We have been fortifying companies and communities through our investments, helping to tackle some of the world’s pressing challenges, including decarbonization, the retirement crisis and financial inclusion.

People and culture: Our people and connected culture are at the heart of value creation. Our track record of investment excellence has attracted innovative and entrepreneurial individuals. Combined with a culture of collaboration and partnership, this gives us a distinctive edge.

By Jun-Ho Cha

chacha@hankyung.com

In-Soo Nam edited this article.