New funding to South Korean tech startups dropped to its lowest levels in seven years in 2024. But seed funding soared 142% led by semiconductor, healthcare and software platforms, data showed on Monday.

Korean tech startups raised a total of $1.5 billion in 2024, down 60% from the year prior, according to market tracker Tracxn Geo. The figure also represented a 71% decline from the $5.2 billion raised in 2022.

Late-stage funding was the most impacted, plummeting 82% to just $500 million from $2.8 billion in both 2023 and 2022.

That contrasted with a 142% on-year surge in seed-stage funding that reached $119 million in 2024, compared with $49.2 million in 2023.

After peaking in 2021, South Korean tech startups saw a continuous decline in funding amid political instability and an economic slowdown, coupled with the sharp decline in the Korean won.

“A significant decline was observed in the number of mega-rounds, with only one $100 million and plus funding round in 2024, as against nine in 2023,” said Tracxn in its annual report, referring to Rebellions. The report is titled the Tracxn Geo Annual Report: South Korea Tech 2024.

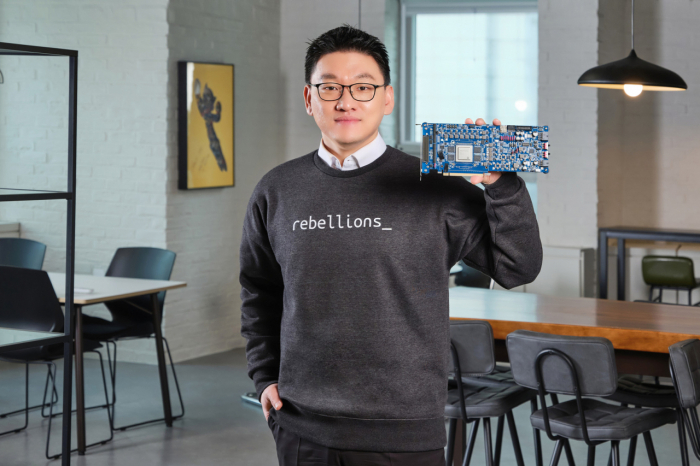

Rebellions Inc., an AI chip designer, reported the largest funding round of the year in this sector, raising $124 million in its Series B round. The company secured a total of $138.4 million across two funding rounds in 2024.

ABLY Corp., a South Korean e-commerce platform for personalized style shopping, joined the ranks of Korean unicorns of 2024. The company raised $71 million in its Series B round, achieving a valuation of $2.1 billion.

By sector, enterprise applications, semiconductor and healthcare platforms were the top-funded segments in 2024.

The enterprise applications sector brought in $568 million in equity capital, marking a 40% increase from $405 million in 2023.

Semiconductor companies witnessed an impressive 171% growth, raising $271 million in 2024 compared to $100 million in 2023. Rebellions accounted for 51% of the total funding in the semiconductor sector.

Healthcare-related technology startups secured funding worth $177 million in 2024, a 36% rise from $130 million in 2023.

The IPO landscape witnessed a sharp upward move, with 27 companies going public in 2024, more than double the 13 IPOs in 2023. Finemedix Co., a medical device manufacturer, was among the notable public listings in December 2024.

But the number of M&As involving Korean startups fell to 19 in 2024, compared to 26 in 2023

Korea Investment Holdings, IMM Investment, and Aju IB Investment were the most active startup investors across sectors.

FuturePlay, Mashup Ventures, and STH emerged as the leading seed-stage investors in 2024, while Hana Ventures, Shinhan Venture Investment and Atinum Investment were the top early-stage investors.

DS Investment Partners, Jeneration and RPS Ventures were the most active late-stage investors in 2024.

By Yeonhee Kim

yhkim@hankyung.com

Joel Levin edited this article.