LG Display Co., the world’s top large-sized organic light-emitting diode (OLED) panel maker, will likely swing to profit this year for the first time in four years, thanks to Chinese consumers’ fast migration toward OLED TVs as a premium TV option.

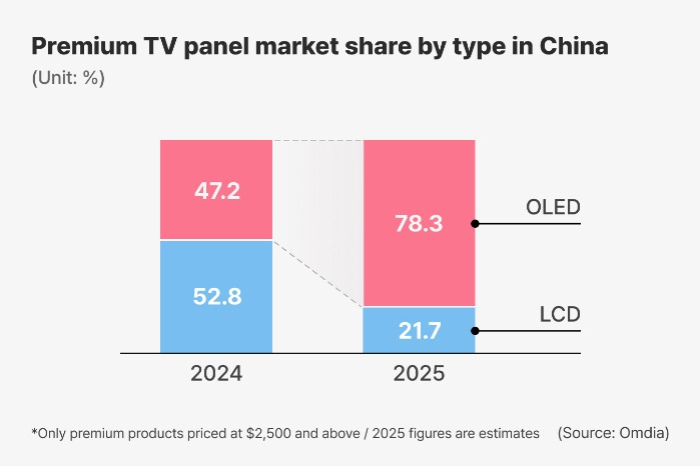

According to data released by global tech research and advisory group Omdia on Monday, OLED screens are forecast to make up 78.3% of China’s premium TV market in 2025, up 31.1 percentage points from the previous year’s 47.2%.

Over the same period, the share of LCD panels in the market is projected to shrink to 21.7% from 52.8%.

The premium TV market is still small in China because only TVs with a price tag of 10,000 yuan ($1,370) or cheaper per set are subject to government subsidies, which rebate 20% of a TV retail price or up to 2,000 yuan.

Currently, annual sales of high-end TVs in China are estimated at 200~300 billion won ($140~211 million).

Against the background, the latest outperformance of OLED TVs in the country’s premium TV market suggests that OLED is set to emerge as a mainstream panel in the TV market.

China, the largest producer of liquid crystal display (LCD) panels, has been promoting mini LED, which is often pitched as a rival to OLED, as the mainstream display technology for premium TVs.

But the latest trend signals a takeoff of OLED TVs in China, which could repeat the trend in Europe and the US, where OLED TVs make up more than 70%.

TURNAROUND IN LG’S OLED BUSINESS

Thanks to the acceleration of OLED TV adoption worldwide, LG Display’s large-sized OLED panel business is projected to swing to profit in the first half of this year, analysts said.

LG Display commands more than 80% of global TV OLED shipments. It supplies OLED screens for TVs of not only its parent, LG Electronics Inc., but also its competitors, such as Samsung Electronics Co. and Sony Corp.

LG Display went all-in to develop OLED TV panels in the 2010s, when the OLED panel market was just opening.

However, due to the delayed adoption of OLED screens in TVs coupled with its weak presence in the small and mid-sized OLED panel market, LG Display dipped into the red in 2022 and 2023, with a loss of more than 2 trillion won ($274 billion) each year.

Under the direction of its new chief, Jeong Cheol-dong, who joined the company in December 2023, LG Display has rigorously reformed the business portfolio by shoring up its small and mid-sized OLED businesses while rationalizing the large OLED business.

Once the large OLED business succeeds in returning to profit, LG Display’s turnaround would gain further traction, according to analysts.

The display industry forecast LG Display will report more than 500 billion won in operating profit in 2025, marking the first profit since 2021.

OLED LEADS THE WAY

OLED screens are rapidly replacing traditional LCD panels in large TVs and gaming monitors. OLED’s response time is much faster than LCD’s while providing clear images with a three-dimensional effect.

Back in the mid-2000s, Korea led the global LCD TV panel market with LG Display and its crosstown rival Samsung Display Co. accounting for nearly half of global shipments of such displays.

But after Chinese players, led by BOE and CSOT, emerged as formidable competitors, armed with generous state subsidies, LG and Samsung were pushed out of the business.

Now, the two Korean display leaders rule the OLED market as the advanced panel technology has become mainstream in the TV and smartphone segments.

OLED is highlighted by self-illuminating pixels that do not require a separate light source, allowing manufacturers to produce lightweight, thin and flexible display products, appealing to high-end consumers.

By Eui-Myung Park

uimyung@hankyung.com

Sookyung Seo edited this article.