LG Energy Solution Ltd. has secured a string of billion-dollar energy storage system (ESS) deals in Japan and Europe, outmaneuvering Chinese rivals in a rare breakthrough for a South Korean battery maker in traditionally China-dominated markets.

LG Energy has signed a contract to supply more than 2 gigawatt-hours (GWh) of lithium iron phosphate (LFP) batteries to Japan’s Omron Corp. over five years, starting at the end of this year, people familiar with the matter said on Tuesday.

The deal, estimated at about 1 trillion won ($700 million), covers both residential and commercial ESS applications, sources said.

The Seoul-based battery maker is also close to finalizing another deal worth 1 trillion won or more with a major European solar company, identified only as “Company F,” for the supply of LFP batteries for similar applications. The two firms could sign an agreement as early as next month, sources said.

Negotiations are ongoing with three to four other European firms, with potential deals valued at between 3 trillion won and 4 trillion won collectively, they said.

Analysts said LG’s total ESS order book could exceed 10 trillion won, or $7 billion, marking a new high-water mark for a Korean battery maker in the ESS segment.

OUTMANEUVERING CATL, BYD, EVE ENERGY

The spate of deals is particularly significant given that Korean battery makers have struggled to gain traction in the ESS space, especially in Europe, where Chinese manufacturers – led by Contemporary Amperex Technology Co. Ltd. (CATL), BYD and EVE Energy – have long dominated the market.

LFP batteries, which are cheaper and more thermally stable than their nickel-based counterparts, have recently gained traction in the ESS market, where energy density is less of a concern than cost and durability.

Chinese battery players have dominated the LFP space, while Korean peers have focused on more expensive nickel-based batteries, such as nickel-cobalt-manganese (NCM) cells.

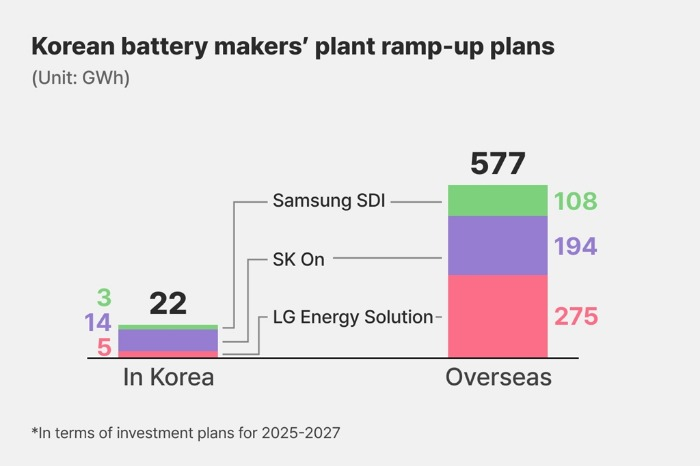

Korea’s battery trio – LG, Samsung SDI Co. and SK On Co. – in recent years changed gears to also manufacture LFP batteries for electric vehicles and energy storage systems.

LG Energy’s pivot away from its NCM focus appears to be paying off.

The company began developing LFP-based ESS products several years ago and has since retooled portions of its EV battery manufacturing facilities in the US and Poland to produce ESS batteries instead.

Commercial production at its Michigan facility is scheduled to begin on May 1, with its Polish factory set to come online by year-end.

LG is also considering converting part of its Ochang plant in Korea to further expand ESS output, sources said.

‘EV CHASM’

The deals come as global EV battery makers are adjusting to what analysts are calling the “EV chasm” – a lull in demand between early adoption and mass market uptake.

With subsidies tightening and interest rates weighing on consumer demand, global battery makers are looking to the rapidly expanding ESS sector to diversify revenue streams.

LG’s recent string of deals adds to a growing list of ESS contracts secured in the US, including over 5 trillion won worth of agreements with energy companies such as Terra-Gen LLC and Excelsior Energy Capital (Excelsior) between November 2024 and March this year.

SAMSUNG SDI, SK ON

LG’s crosstown rivals – Samsung SDI and SK On – are also pivoting toward ESS to weather EV market slowdown.

Samsung SDI has begun supplying lithium-ion batteries to NextEra Energy Inc., the largest electric utility in the US.

Sources said Samsung has started deliveries of nickel-cobalt-aluminum (NCA) batteries with a total capacity of 6.3 gigawatt-hours (GWh), equivalent to 11.5% of the entire North American ESS capacity installed last year.

The total deal is worth 1 trillion won, with Samsung set to deliver 437.4 billion won worth of batteries by November, according to sources.

Samsung SDI plans to complete a pilot LFP battery production line at its Ulsan facility in Korea in the first half before ramping up output with a capacity of up to 10 GWh next year.

Discussions are also underway to potentially establish a dedicated LFP production plant in the US, sources said.

SK On, a subsidiary of energy firm SK Innovation Co., is also repositioning itself for the ESS market.

Last September, it signed an initial agreement with IHI Terrasun Solutions, a US-based energy firm, to provide batteries for grid-scale storage applications.

SK On said it is exploring a plan to repurpose idle production capacity at its EV battery plant in Georgia. The facility, which currently manufactures NCM batteries, could be partially converted to produce LFP cells.

By Sang-Hoon Sung, Woo-Sub Kim and Jin-Won Kim

uphoon@hankyung.com

In-Soo Nam edited this article.