South Korean pension funds continued their buying spree on the Kospi market for a fourth month in a row in November, marking their largest net purchases on the main bourse for a single month, according the Korea Exchange.

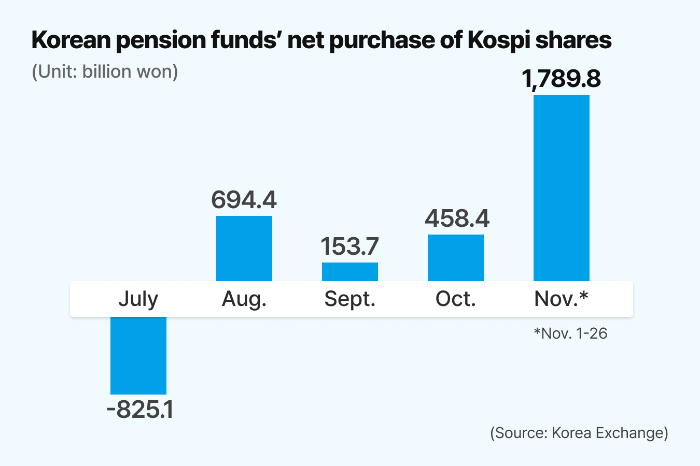

Those funds, led by the National Pension Service, have bought a net 1.8 trillion won ($1.2 billion) in shares listed on the Kospi since the start of this month through Nov. 26, the bourse operator said on Tuesday.

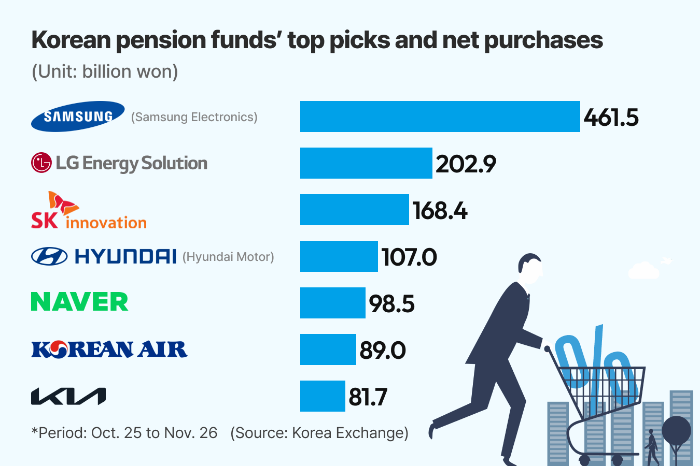

They scooped up leading exporters such as semiconductor, automobile and battery companies, weighed by declining profits amid global uncertainties over Donald Trump’s new policies in his second term.

They hunted for bargains after the Kospi index tumbled to the 0.85 multiple of the average book value of its listed companies, down 5% year to date. It is the worst performer among major Asian stock markets this year.

The series of recently-announced, share price-boosting measures, including Samsung Electronics’ 10-trillion-won buyback, improved investor confidence.

Samsung Electronics Co., the largest stock on the Kospi, has lost nearly 30% this year, breaking below the psychologically important barrier of 50,000 won on Nov. 14 before rebounding above the level.

Korean pension funds turned to net buyers of Kospi stocks in August after unloading a net 825.1 billion won in July, when the Kospi climbed to its highest levels for this year.

By comparison, individual investors purchased a net 2.0 trillion won in Kospi-listed stocks this month. But excluding their investments in exchange traded funds, their net purchases on the Kospi came in at 274.5 billion won, according to the Korea Exchanger.

The Kospi 200 index, tracking stocks traded the most with large market capitalization, stands at 8.92 times its forward price-to-earnings ratio as of Nov. 26.

This month, the Korean won currency weakened below the 1,400 won level against the US dollar, hitting a two-year low. The dollar/won rate is now traded slightly below the ceiling.

Pension funds were selective in chasing rechargeable battery stocks amid a slowdown in electric vehicle demand.

LG Energy Solution Ltd., however, was high on the list of their net purchases on expectations the supplier to Tesla Inc. would be less vulnerable to the likely cuts in EV tax credits pledgd by Donald Trump during his presidential campaign.

Meanwhile, the yield on South Korea’s benchmark three-year treasuries fell to its lowest point in nearly three years, hitting 2.773% on Tuesday.

By Tae-Ung Bae

Btu104@hankyung.com

Yeonhee Kim edited this article.