Samsung Biologics Co., the world’s largest contract drugmaker, said on Wednesday it has signed two drug manufacturing contracts worth a combined $668 million with an unidentified European biopharmaceutical firm.

The contracts, set to last until the end of 2031, are valued at 752.4 billion won ($539 million) and 178 billion won, respectively, Samsung said in a regulatory filing.

The biotechnology unit of Korea’s top conglomerate Samsung Group didn’t identify the client.

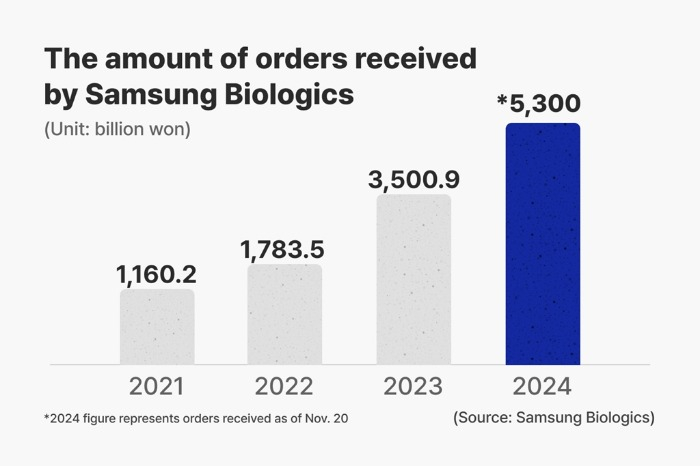

The latest agreements bring up the company’s cumulative contract value for this year to more than 5 trillion won, or $4 billion, a record annual high and 1.5 times that of 2023.

The company has secured 11 deals to manufacture drugs for other companies so far this year.

“We are delighted to expand our partnership with the European pharmaceutical company toward our shared commitment to delivering high-quality biopharmaceuticals to patients,” said John Rim, chief executive of Samsung Biologics. “As we further expand strategic collaboration with clients worldwide, we also make continued investments in our capabilities and manufacturing technologies. Our goal is to provide the highest quality services at every stage and deepen our trusted partnerships.”

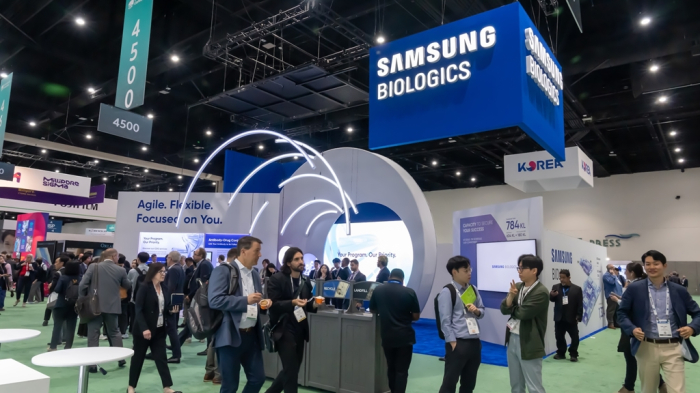

The company has proactively addressed the evolving needs of clients with a series of significant deals this year, solidifying its customer base across the US, Asia and Europe.

Samsung Biologics said it has now partnered with 17 of the world’s top 20 pharmaceutical companies and continues to extend contracts with existing clients to support them in advancing innovative therapies.

DEDICATED ADC FACILITY BY YEAR-END

Samsung Biologics is set to add antibody-drug conjugate (ADC) services to its portfolio, with a dedicated facility to be completed by the end of this year.

The company will provide a range of services, including ADC process development and conjugation, leveraging its comprehensive understanding of biologics and expertise in antibody manufacturing and engineering.

Samsung Biologics said it expects to see the opening of Bio Campus II next year, with Plant 5 on track to be operational in April 2025.

The company has focused on manufacturing drugs for others in a scheme known as a contract manufacturing organization (CMO) for over a decade.

It now aims to solidify its leadership in the contract development and manufacturing organization (CDMO) market, which involves cooperation starting at the drug development stage, which is more profitable.

Samsung has been ramping up its facilities to meet growing demand from its clients.

Most biopharmaceutical companies such as Pfizer, Moderna, AstraZeneca, and Janssen, Johnson & Johnson’s pharmaceutical division, focus only on R&D. Without their own production facilities, they outsource production to contract drugmakers.

In terms of capacity, Samsung Biologics is already the world’s largest contract manufacturer, followed by Swiss rival Lonza AG and Germany’s Boehringer Ingelheim.

Samsung said in 2022 that it plans to double its manufacturing capacity by building four additional plants worth 7 trillion won to solidify its leadership in the CDMO market.

Once Plant 5 with an annual production capacity of 180,000 liters is completed, the company’s total capacity will rise to 784,000 liters.

Samsung Biologics maintains the industry’s highest regulatory approval rates. As of the end of October, it has received 339 global regulatory approvals in its 13-year history, including 38 from the US Food and Drug Administration (FDA) and 33 from the European Medicines Agency (EMA).

SK PHARMTECO, BINEX, ST PHARM

Korea is home to the world’s leading contract drug manufacturers, including Samsung Biologics, SK Pharmteco, Binex Co. and ST Pharm Co.

While Samsung focuses on antibody drugs, SK Pharmteco is carving out a niche in synthetic drugs, peptides such as obesity treatments, and cell and gene therapies (CGT).

Recently, SK announced a $260 million investment to build a state-of-the-art peptide and synthetic drug plant in Sejong, Korea, aiming to secure contracts from big pharma such as Eli Lilly.

ST Pharm has positioned itself as one of the top three global producers of oligonucleotides, a key component in RNA-based therapies.

In August, it was selected as a supplier for a blockbuster drug ingredient that generates over 1 trillion won in annual sales.

Bionex, which recently secured deals to make biosimilars for Celltrion Inc. and Samsung Bioepis Co., is also close to signing deals with US and European pharma, sources said.

By Dae-Kyu Ahn

powerzanic@hankyung.com

In-Soo Nam edited this article.