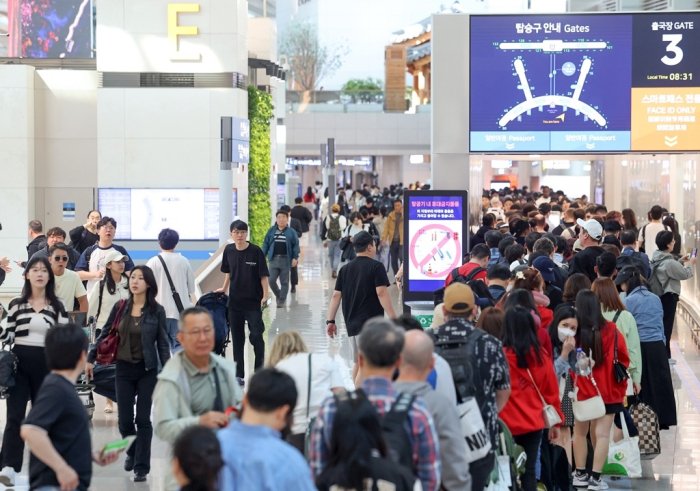

Departure terminal of Incheon International Airport, South Korea’s main gateway, on May 3, 2024 (File photo by Hyuk Choi)

Competition in the South Korean travel money card market intensified as increasing overseas trips and cross-border shopping prompted credit card issuers to lure new customers with such services.

Overseas payments of individual customers of South Korea’s eight credit card issuers rose 28% to 7.5 trillion won ($5.4 billion) in the first five months of 2024 from a year earlier, according to the Credit Finance Association on Monday. Among the sum, payments with credit cards totaled 5.6 trillion won, while settlements with debit and check cards stood at 1.9 trillion won.

Hana Card Co., South Korea’s No. 7 credit card issuer by assets, was the top player during the period with a market share of 19.8% as its customers paid 1.5 trillion won for overseas settlements through its credit, debit and check cards.

The company accounted for 52% of the market of overseas payments with check cards in January-May 2024.

HANA, KOREA’S FIRST TRAVEL MONEY CARD ISSUER

The wholly-owned subsidiary of Hana Financial Group whose baking unit is South Korea’s largest foreign exchange market player launched the Travelog Check Card in June 2022.

That was the country’s first travel money card, which can hold foreign currencies intended for overseas trips. Users can use the card to withdraw foreign cash from automated teller machines (ATMs) in other countries and to make purchases in a local unit.

“Travelog card had not drawn much attention due to COVID-19 when it was introduced,” said a Hana Card official. “But the card went viral through various blogs as the pandemic became an endemic.”

The Hana Travelog Check Card, South Korea’s first travel money card (File photo)

LARGER PLAYERS JOIN COMPETITION

Other credit card issuers rushed to unveil similar services with benefits such as free currency exchange, fee exemption and complimentary airport lounge services to attract new customers.

Shinhan Card Co., the country’s largest credit card issuer by assets, introduced the SOL Travel Check Card in February. Shinhan Card was the No. 2 player in the overseas payment market with a 19.2% in the January-May period.

KB Kookmin Card Co. launched the KB Kookmin Travelers Check Card and Samsung Card Co. unveiled the iD Global Card in April. Woori Card Co. introduced the Wibee Travel Check Card in June.

Credit card units of major financial holding companies such as KB Financial Group, Shinhan Financial Group and Woori Financial Group linked travel money cards to foreign currency accounts of their banking affiliates.

A customer, who wants to use the SOL Travel Check Card, needs a foreign currency account at Shinhan Bank, for example.

“A travel money card is important not only for card issuers but also for banks to attract customers,” said an industry source. “The product is very effective in locking in the existing customers.”

By Hyeong-Gyo Seo

seogyo@hakyung.com

Jongwoo Cheon edited this article.

Leave a Reply